Global Specialty Pulp And Paper Chemicals Market is expected to reach USD 25.71 billion by 2020, according to a new study by Grand View Research, Inc. Growing demand for specialty paper is expected to be a key driver for the market over the forecast period. Technology innovation, focusing on sustainable processes to minimize environmental impact is expected to be a critical factor for market development over the next six years.

Functional chemicals were the largest product segment with market revenue of USD 10.23 billion in 2013. Surging demand for pigmented, dyed and coated paper in industrial, consumer and art applications is expected to drive functional chemical demand over the forecast period. Bleaching chemicals were the second largest product segment with market revenue of USD 4.23 billion in 2013.

View

summary of this report @ http://www.grandviewresearch.com/industry-analysis/specialty-pulp-paper-chemicals-market

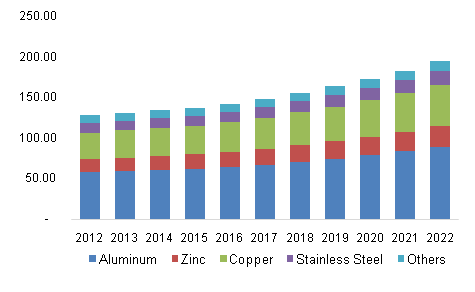

Europe specialty pulp and paper chemicals market, by products, 2012 - 2020 (USD Million)

Further

key findings from the study suggest:

- Functional chemicals are expected to be fastest growing product segment, at an estimated CAGR of 4.7% from 2014 to 2020.

- Process chemicals are expected to follow functional chemicals in terms of growth at an estimated CAGR of 4.3% from 2014 to 2020. Process chemicals are used to expedite and increase the overall efficiency of the process used for specialty paper manufacturing.

- Europe was the largest market for specialty pulp and paper chemicals, accounting for 42.4% of market share in 2013. The market is expected to lose share to North America on account of mature paper market in Europe coupled with growing wood and pulp industry in the U.S. and Canada.

- Asia Pacific is expected to be fastest growing market, at an estimated CAGR of 7.1% from 2014 to 2020 on account of growing retail market in Japan. Indonesia, China, India coupled with expansion of pulp and paper industry in Indonesia, China and South Korea.

- Specialty pulp and paper chemicals market was consolidated, with key companies being BASF, Kemira, AkzoNobel, Ashland Hercules, Dow Chemicals, ONDEO Nalco accounting for 83.0% of market share in 2013.

Browse All Reports of

this category @ http://www.grandviewresearch.com/industry/plastics-polymers-and-resins

For the purpose of this study, Grand View Research has segmented the global specialty pulp and paper chemicals market on the basis of product and region:

Specialty pulp and paper chemicals Product Outlook (Revenue, USD Million, 2012 - 2020)

• Bleaching chemicals

• Process chemicals

• Functional chemicals

• Basic chemicals

Specialty pulp and paper chemicals Regional Outlook (Revenue, USD Million, 2012 - 2020)

• North America

• Europe

• Asia Pacific

• RoW